A cosigned promissory note is a lawfully binding IOU: a formal, written promise in which one event consents to pay back the cash they borrowed from another party.

A cosigned promissory note is essentially a written debenture someone. This sort of paper is common in financial solutions and is something you have actually most likely signed in the past if you have actually gotten any type of type of financing. If you determine to lend money to someone, you might intend to develop a cosigned promissory note to define the car loan.

What is a promissory note?

Promissory notes may additionally be described as an IOU, a financing agreement, or just a note. It’s a lawful loaning record that claims the consumer promises to repay to the loan provider a specific quantity of cash according to specific specified terms. When performed effectively, this kind of file is legitimately enforceable and creates a lawful obligation to pay off the financing.

Secret components

Cosigned promissory notes are fairly simple, normally including simply 2 parties: the customer (the ‘maker’) and the cash lender (the ‘payee’). It’s feasible to develop a secured cosigned promissory note (backed by security or properties) or an unprotected promissory note, relying on the type of financial obligation.Read here Arizona Standard Promissory Note At our site

Despite the kind, below’s what a cosigned promissory note normally consists of:

- Identification. Full names and addresses of the manufacturer and payee.

- Loan details. The quantity obtained, interest rate (if suitable), and settlement terms, consisting of the payment timetable and maturation day.

- Safety and security or collateral. Description of properties used to secure the financing (not applicable to unsecured promissory notes).

- Default and late settlement terms. Problems that constitute a lending default and any type of fines for late payments.

- Prepayment terms. Details on very early repayment options and any kind of associated costs.

- Trademarks and dates. Both parties should authorize and date the file for it to be legitimately binding.

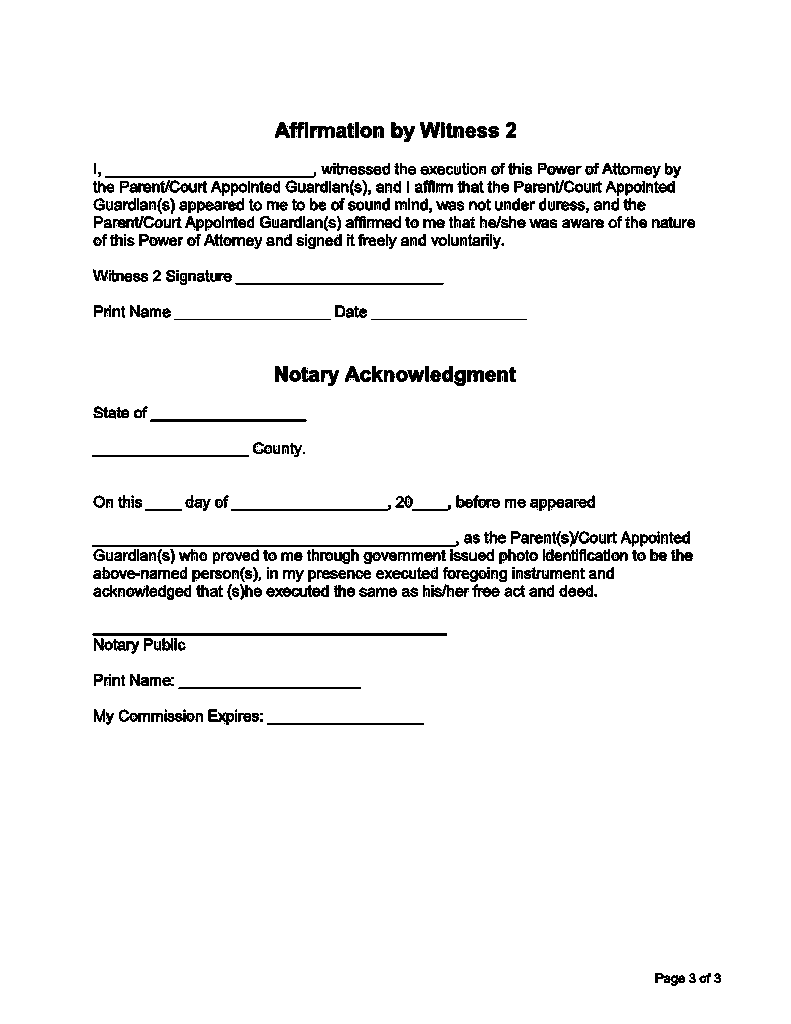

Like various other lawful files, cosigned promissory notes commonly consist of miscellaneous terms or areas, such as provisions for exactly how to take care of conflicts. It’s additionally a great concept to notarize the note, especially for casual contracts that are most likely to be challenged.

Promissory note instances

To better recognize exactly how promissory notes operate in technique, allow’s review 2 prospective examples of how they can be used:

1. Personal car loans in between relative

Close friends and relative might use a promissory note to define an individual car loan. For example, a current university grad can obtain $5,000 from their moms and dads to cover moving expenses for a brand-new job. In this scenario, the promissory would typically include these terms:

- The $5,000 financing amount and any agreed-upon interest rate fees

- A settlement schedule (e.g., $200 monthly for 25 months)

- Any type of effects for late or missed settlements

As long as both events agree, the promissory note efficiently acts as a lawfully binding agreement and holds the current grad in charge of settling their parents.

2. Vehicle loan promissory note

When financing a cars and truck purchase, many lending institutions call for the purchaser to sign a cosigned promissory note with the financing agreement that has the adhering to parts:

- Overall amount obtained

- The interest rate (APR) and loan term (e.g., 5% APR for 60 months)

- Regular monthly settlement quantity

- Details regarding late charges and consequences (e.g., the lending institution’s right to reclaim the lorry in case of a default)

The loan provider holds the cosigned promissory note until the debtor repays the loan, after which it ends (comparable to a lien). In other situations, the lender can make use of the promissory note to gather financial debts if the borrower does not follow through with the terms.

When to use a promissory note

A cosigned promissory note is utilized for home mortgages, student car loans, auto loan, business financings, and individual lendings between friends and family. If you are offering a large quantity of cash to a person (or to an organization), then you may want to develop a promissory note from a cosigned promissory note theme. This note will be a lawful document of the finance and will certainly protect you and help see to it you are paid back.

Still, it’s critical to comprehend the ramifications before you produce or sign a promissory note. Right here are some benefits and disadvantages to bear in mind:

Pros

- Security. A promissory note shields the loan provider’s and debtor’s interests by plainly describing each event’s commitments and legal rights.

- Adaptability. These notes can be used in different borrowing situations, from individual finances in between friends to formal organization purchases.

- Easier to acquire. In particular scenarios, safeguarding a funding with a cosigned promissory note may be easier than going through a traditional bank.

- Preserve relationships. A promissory note can clarify expectations and stop conflicts when utilized in informal circumstances with friends and family.

Disadvantages

- Does not get rid of all dangers. While a promissory note gives legal defense, there’s always an opportunity the customer could miss settlements or default on the financing totally.

- Requires cautious composing. Like various other legal records, a cosigned promissory note has to have the needed info and adhere to local regulations in order to be enforceable.

- May not cover all contingencies. In intricate borrowing circumstances, a basic promissory note could not address all feasible situations or complications that could develop.

Provided the potential dangers, it’s a good idea to get in touch with an attorney-especially if you’re not comfortable collaborating with legal documents or if you have any questions about your cosigned promissory note.

What to include in a cosigned promissory note

A lending promissory note sets out all the terms and information of the financing.

The cosigned promissory note form ought to include:

- The names and addresses of the lender and customer

- The quantity of money being obtained and what, if any, collateral is being made use of

- Just how commonly payments will certainly be made in and in what quantity

- Trademarks of both events, in order for the note to be enforceable

The collateral referenced over is a residential property that the lender can take if the note is not paid back; for example, when you buy a home, your home is the security on the mortgage.

Just how to personalize a cosigned promissory note

Cosigned promissory notes should be produced to fit the transaction that you are associated with. It’s always good to refer to a sample cosigned promissory note when you are writing one to make sure that you can be certain to include the ideal language. There additionally are different types of promissory notes.

A basic cosigned promissory note might be for a lump sum payment on a particular day. For example, allow’s claim you provide your close friend $1,000 and he consents to settle you by December 1st. The sum total is due on that particular day, and there is no repayment timetable included. There might or may not be rate of interest charged on the loan quantity, relying on what you have actually agreed.

A need cosigned promissory note is one in which settlement schedules when the lender asks for the money back. Usually, a reasonable amount of notice is called for.

More complicated cosigned promissory notes for deals like home loans and auto loan will certainly likewise consist of interest rates, amortization timetables, and other details.

Just how to accumulate on a promissory note

If you’ve offered money to someone utilizing a cosigned promissory note, the plan is for them to repay you according to the terms of the note, which in most cases is what occurs. But suppose they don’t satisfy the regards to the note?

The first thing to do is actually to request for the settlement in creating. A written pointer or request is typically all that is needed. You might send out unpaid notifications 30, 60, and 90 days after the due day.

Be sure to speak with your consumer. Can they make a deposit? Would certainly an extensive payment plan enable them to compensate? If you decide to accept a partial settlement of the financial obligation, then you can develop a debt negotiation contract with your consumer.

An additional choice is to use a financial obligation collection agency. This business will certainly work to accumulate your note and will usually take a portion of the financial debt. You additionally can sell the note to a debt enthusiast, suggesting they have the loan and collect the sum total (this resembles what occurs when financial institutions offer lendings per various other). If all else stops working, you can sue the customer for the total of the financial debt.

Promissory notes are a beneficial method to establish a clear record of a loan-whether in between entities or individuals-and to put all the pertinent terms in composing, so that there can be no question regarding the quantity of cash provided and when payments are due.

What occurs if a promissory note is not paid?

When consumers stop working to meet the repayment terms, they formally default on the loan. This circumstance can lead to several effects:

- Credit score effect. If the loan provider reports the default to credit scores bureaus, the debtor’s credit report can drop considerably, impacting their capacity to secure loans in the future.

- Security seizure. With safeguarded promissory notes, the lending institution may have the right to take certain building to repay the financing.

- Legal action. As a last hope, the loan provider may submit a legal action versus the debtor to recuperate the unpaid debt. If effective, the court might allow the lender to garnish earnings or place liens on the borrower’s building, depending on the jurisdiction’s laws and the sort of debt.

Lawsuits can be expensive and lengthy for both parties, which is why numerous lending institutions seek alternative remedies, as formerly discussed. In these situations, it’s extremely advised to seek advice from an attorney to secure your rights.

FAQs

What are the different types of promissory notes?

Normally speaking, cosigned promissory notes can be categorized as secured (backed by collateral) or unprotected. Typical types consist of promissory notes for mortgage loans, federal pupil fundings (likewise called a master cosigned promissory note), automobile finances, and individual lendings in between buddies or household, among other possible usages. It is essential to keep in mind that bills of exchange and promissory notes are not the same.

Is a cosigned promissory note legally binding?

Yes, an effectively carried out promissory note is lawfully binding. As long as the note consists of all necessary aspects, is authorized by the entailed parties, and adhere to applicable laws, it’s enforceable in court if the consumer defaults or stops working to satisfy their commitments.

Can a cosigned promissory note be transferred or sold?

Yes, a lender might sell or move a promissory note to a debt collection agency if the borrower defaults. Some organizations may acquire promissory notes as well, yet this is a lot more usual in institutional or corporate financial investments with high governing oversight.

Can you compose your very own cosigned promissory note?

Yes, you can write your very own promissory note. Nevertheless, it’s recommended to consult a lawyer to ensure the lawful file is valid and lawfully enforceable. It’s additionally an excellent idea to obtain your promissory note notarized to prevent future disputes.

Who possesses a cosigned promissory note?

The lender-known as the payee-is normally the owner of the original cosigned promissory note until the customer pays off the finance. In many cases (like for a mortgage), the note may additionally be held by a financial institution or investment group.